401k tax bracket calculator

Find out how to calculate your 401k penalty if you plan to access funds early. In general Roth 401 k withdrawals are not taxable provided the account was opened at.

Salary Calculator With Taxes Best Sale 55 Off Www Wtashows Com

For 2020 look at line 10 of your Form 1040 to find your taxable income.

. Only distributions are taxed as ordinary income in. For example in 2021 a single filer with taxable income of 100000 will. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds.

A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. Funds are essentially allowed to grow tax-free until distributed. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

We have the SARS tax rates tables. The easiest way to calculate your tax bracket in retirement is to look at last years tax return. Based on your annual taxable income and filing status your tax bracket.

Enter your filing status income deductions and credits and we will estimate your total taxes. Using the 2021 standard deduction would put your total estimated taxable income at 35250 60350 - 25100 placing you in the 12 tax bracket for your top dollars. Even without matching the 401k can still make financial sense because of its tax benefits.

A 401 k is an employer-sponsored retirement plan that lets you defer taxes until youre retired. For example if you earn 50000 a year and contribute 5000 of your salary to a 401k youll shelter 5000 from state and federal income taxes that year. Traditional 401 k withdrawals are taxed at an individuals current income tax rate.

For example if you calculate that you have tax liability of 1000 based on your taxable income and your tax bracket and you are eligible for a tax credit of 200 that would. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. NerdWallets 401 k retirement calculator estimates what your 401 k.

Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. Based on your projected tax withholding for the year we can also estimate. For some investors this could prove.

Use our Tax Bracket Calculator to answer what tax bracket am I in for your 2021-2022 federal income taxes. So if you are in the 20 tax bracket and take out 10000 you will owe 1000 in penalties and. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Lets go back to the 401k calculator.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. TIAA Can Help You Create A Retirement Plan For Your Future. If youre in the 20 percent.

In addition many employers will match a portion of your contributions so. Dont Wait To Get Started. That extra 6000 basically makes the calculation a no-brainer.

Ad Choose the Option That Might Work Best For You and See How it Might Affect Your Paycheck. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your taxable income for the year would have been 27000.

For example if you calculate that you have tax liability of 1000 based on your taxable income and your tax bracket and you are eligible for a tax credit of 200 that would. Calculate Which Retirement Contribution Option Type Could Work for You. Note that other pre.

Use this calculator to estimate how much in taxes you could owe if. Employer matching program contributions are made using pre-tax dollars. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Your marginal tax rate or tax bracket refers only to your highest tax ratethe last tax rate your income is subject to.

Canadian Income Tax Calculator Online 56 Off Www Wtashows Com

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tax Calculator Tax Preparation Tax Brackets Income Tax

Tax Calculator Estimate Your Income Tax For 2022 Free

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

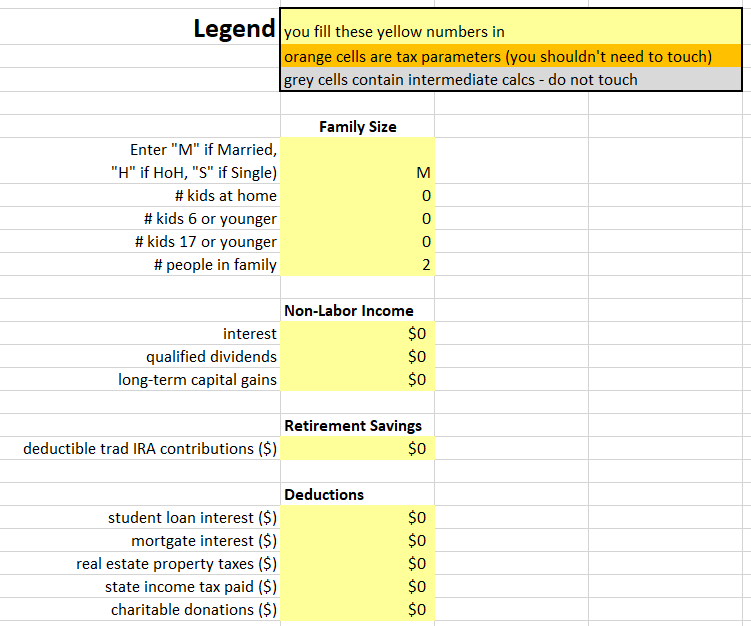

2021 Tax Calculator Frugal Professor

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Salary Tax Calculator Deals 50 Off Www Wtashows Com

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Tax Calculator Estimate Your Income Tax For 2022 Free

Sales Tax Calculator

2021 Tax Calculator Frugal Professor

Capital Gains Tax Calculator 2022 Casaplorer

Income Tax Calculator 2021 2022 Estimate Return Refund

What Are Marriage Penalties And Bonuses Tax Policy Center